The Tesla Takedown protests are gaining momentum, with protests happening worldwide every weekend at a growing number of Tesla sales centers.

Many of the protestors are middle class earners, probably lean left in their politics and are objecting to the actions of Tesla CEO, Elon Musk in the US government.

But some of those people are also likely to be shareholders of Tesla, even if they don’t know it.

About half of Tesla’s 3.1 billion outstanding shares are owned by institutions that must report their holdings quarterly on form 13F. Those institutions include registered investment advisers (RIAs), banks, insurance companies, hedge funds, trust companies, pension funds and mutual funds. Institutions with more than $100 million in assets under management are obligated to report their holdings.

It is more than likely that some of the Tesla protestors own Tesla shares indirectly through one or more of those institutions.

As of the last reporting date (Dec31st,2024) 3,904 institutions held 1,516,922,857 Tesla shares, excluding options and excluding any short positions. Those shares were valued at over $612 billion at the time, though their value has since fallen to about $350 billion.

If you invest in mutual funds or index funds, or you depend on a pension plan for your retirement, you probably own Tesla shares.

Index funds

Tesla shares are included in the S&P 500 and the Nasdaq 100 indices. If you own ETFs or mutual funds that track those indices, you own Tesla shares

Index funds probably account for more than half of the institutional holdings of Tesla shares. Tesla’s share of the indices is based on market cap which rises and falls with the share price, the approximate shares at today’s share prices are:

S&P 500 1.87%

Total Stock Market 1.6%

Nasdaq 100 2.37%

When an investor buys or sells a fund that tracks the index, that fund will buy or sell each of the index components in proportion to their weight in the index. Even though the weighting is small, the massive flows in and out of index funds are enough to drive share prices higher or lower.

If you own index funds or ETFs, it is possible to offset your Tesla holdings by shorting Tesla in the correct proportion, but it is not very practical. A better approach would be to sell your index funds and reinvest in funds that track an index of dividend paying stocks. Tesla does not pay a dividend, therefore should not be in any of the dividend trackers.

As well as eliminating your Tesla ownership, you will probably gain by being in safer, dividend paying investments in what might be an upcoming market correction.

Active funds

If you own actively managed funds, go to the fund website and look up the fund’s holdings. If the fund claims to be a growth fund, it will probably hold Tesla shares, even though Tesla stopped growing two years ago.

Value funds are less likely to own Tesla shares, but are worth checking, because fund managers sometimes stray from the fund’s strategy.

If you own funds that own Tesla, you can move your investment to another fund but check first if there are any fees for redemptions. Usually, you can move investments between funds with the same company without charge.

Pension Plans

It is shocking how many pension plans are holding Tesla, a grossly overpriced high risk bubble stock that would not normally be regarded as a suitable investment for a pension.

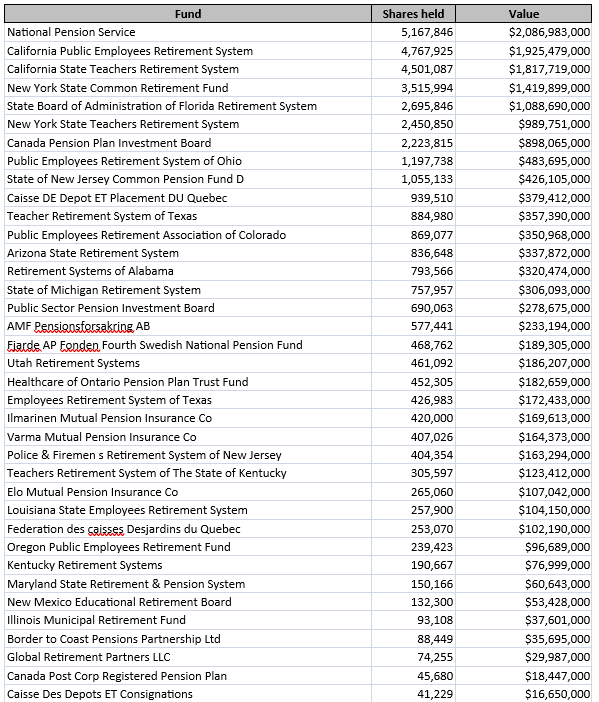

Here’s a list of pension plans that held more than $10 million worth of Tesla shares according to their latest 13F forms. It may not be totally accurate, I have simply filtered the list of institutional holders for those with “pension” or “retirement” in the name.

56 pension plans and retirement funds held 39 million Tesla shares worth $15 billion as of Dec 31st. The ones that still hold Tesla shares have seen a 40% drop in the value of that investment this quarter.

As you can see, many of the larger holders are state and public sector pension plans. Many of the plans belong to the same people that Elon Musk is trying to fire as part of his efforts to reduce the cost of government services.

If your pension plan owns Tesla shares, you can contact the manager of the plan and express your objections, though one person doing that probably won’t have much impact.

Form 13F must be filed within 45 days of the end of the reporting period. We won’t know how many of these funds bought or sold Tesla shares in Q1 until those reports are issued in the middle of May. It will be interesting to see how much impact the funds have had on Tesla’s share price.

If you are part of the Tesla Takedown movement, one of the things you can do is check whether you own Tesla shares and take steps to sell them.

These Tesla and anti-DOGE riots/protests are what happens when you can't win on law and ideas.

https://shorturl.at/FYDtt

They could do what winners do - and put their money where their mouths are - and short the stock.... Although truth be told, I don't think you have to worry about protesters indirectly owning stock in Tesla. Based on what I have seen, their lives are so void of both accomplishment and purpose, that I suspect they couldn't put the scratch together to buy a single share.