It is time to tell the truth about the cost of renewables.

The UKs energy transition is in disarray. Offshore wind, the mainstay of the plan, will cost almost 3 times as much as expected. A review is urgently needed, and a possible change in direction.

In November 2008, the UK passed the Climate Change Act which committed the country to reduce carbon emissions by 80 percent by the year 2050.

In June of 2019, the act was strengthened to make Net Zero emissions a legal requirement by 2050.

At the time there was no viable plan in place and no indication as to how that target might be achieved or how much it would cost. The Climate Change Committee was tasked with coming up with that plan.

In March of 2023, the CCC published its report on the first phase of the transition – “Delivering a reliable decarbonized power system”. The intent is to have a carbon-free electricity supply by 2035 and expand it to a completely decarbonized energy system by 2050 when fossil fuel use in transportation, building heat and industry is fully electrified.

The proposed plan includes both offshore and onshore wind, solar, biomass and nuclear power to provide the bulk of the energy supply. This will be backed up by natural gas with carbon capture and by hydrogen, made initially by reforming of natural gas, and later by electrolysis using surplus wind and solar power. A small amount of unabated gas is used for emergency backup. The plan doesn’t quite meet the Net Zero target, but the CCC claims that cleaning up the 2% of unabated gas cannot justify the cost. I think most people would agree.

The plan includes interconnections to other countries and both short-term and long-term energy storage. The long-term energy storage would be hydrogen in salt caverns, the estimated storage requirement is only 31 GWh for the 2035 case, increasing to 11,000 GWh for 2050.

The plan presented by the CCC looks like a reasonable approach but the one thing missing is an estimate of the cost.

The National Infrastructure Commission has recommended a long-term storage reserve of 8,000 GWh by 2035 and 25,000 GWh by 2040 (more than twice as much as the CCC says is needed in 2050 for Net Zero). The NIC tells us that unabated gas-fired generation must end, but the CCC says otherwise.

The Royal Society adopts a different approach, they argue that the cheapest way to provide the required energy is by wind and solar, and they project a requirement for 123,000 GWh of long-term storage by 2050.

The House of Lords Science and Technology Committee weighed in last week with its report titled “Long-Term Energy Storage – Get On With It”. The British public might be excused for asking “Get on with what?”, because the whole strategy for the energy transition appears to be in disarray.

That workable plan must be accompanied by cost estimates that use real costs, not fantasy cost projections dreamed up to make the plan seem more palatable, or to make one favoured power source seem more viable than another. And those estimates need to be done by a qualified and experienced engineering company, not by a university, a think tank or a quango committee.

In my 40-year career as an engineer I have worked on hundreds of projects, and I have put together dozens of cost estimates. I have developed a keen instinct for spotting when something doesn’t look right, and usually, that indicates that it isn’t right.

For example, in the next round of bidding, the UK is expecting to pay £73/MWh for offshore wind based on 2012 prices, that’s £103.82 at 2023 prices.

But the Royal Society report claims a cost of £61/MWh for a renewables-based electricity supply where the primary generator is offshore wind, including a 30% overbuild of power generation, a massive hydrogen production system, hundreds of huge storage caverns, and a complete duplicate system to supply power from hydrogen when the renewables are not generating. I know that number cannot be right.

If I take the data from the Royal Society study, and instead of using fairy-tale projections of costs, I use real data from real-life applications, the projected cost of the all-renewables system rises to £158.50/MWh. That is 24% higher than the price of power from the Hinkley Point nuclear power plant at 2023 price levels, and more than 2.5 times the price that EDF is proposing to charge for nuclear power in France.

Studies like this are published, presented to politicians and become the basis for policy. If the studies are wrong, then the policies are wrong.

Vested interests latch onto the studies and promote the fallacy that a modern electrical system can operate cheaply on wind and solar alone. The whole country is led down the wrong path, until faced with reality after spending untold sums of money and wasting years going in the wrong direction.

We have to get a handle on real costs. A prominent member of parliament, Jacob Rees-Mogg was roundly criticized for suggesting that the Net Zero strategy be put on hold, indefinitely. He is right, the strategy should be put on hold, at least until a workable plan can be agreed.

The remainder of this article is an explanation of how I arrived at the £158.50/MWh cost figure.

Firstly, we look at wind and solar costs

The Royal Society presented a range of cost estimates. For simplicity, I am working with their mid-point estimate in which they used a cost of £35/MWh for wind and solar, based on 2023 pricing.

In the last round of bidding for supply contracts, solar was quoted at £47, onshore wind was quoted at £52.29 and there were no bids for offshore wind because no one was prepared to construct offshore wind at the maximum price set by the government. The next round of bidding will set a target price of £73/MWh for offshore wind. Those prices are all based on 2012 and will be indexed to the CPI.

Using those recent quotes, it is a simple job to calculate a blended price for wind and solar and apply an inflation index to get the equivalent price for 2023.

The projected cost comes to £89.36/MWh.

Those prices will be paid to wind and solar power producers, for 15 years from the start of production, likely to be sometime in 2026 or 2027.

What possible justification could there be for presenting a cost estimate that uses a price of £35/MWh when fixed contracts are being signed for an average of £89.36/MWh?

Next, we look at how much wind and solar must be generated.

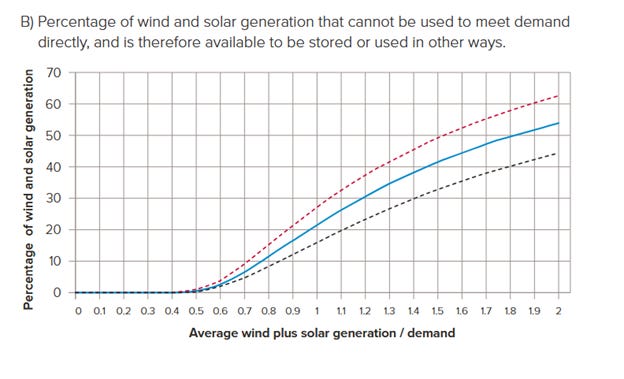

Demand has been calculated at 570 TWh per year, based on full net zero with gas heating converted to heat pumps. But some of the wind and solar production is used to make hydrogen for storage and some is wasted. The Royal Society report includes an estimate of the total generation and a chart that allows us to calculate how much is used directly, how much goes to hydrogen and how much is curtailed. The report tells us that the total generation is 741 TWh/year, which is 1.3 times the projected demand.

This chart from the Royal Society report, tells us that 35% of the wind and solar generated cannot be used to meet demand directly, so 65% is used directly.

From there, it is a simple calculation to figure out where the energy goes.

Some curtailment is inevitable because the peak wind and solar generation only occurs for a few hours per year, and no system can be economical when operated for such a short period.

Almost 30% of the wind and solar energy goes into making hydrogen for storage, but the output from hydrogen is less than 12% of the total energy generated.

So, to make the system work, it must generate 30% more power than we use, so the cost goes up from £89.36 to £116.16/MWh, because we must pay for all the power that is generated.

However, there is more cost, we must include the equipment to make hydrogen, the storage caverns, and the generators to make electricity from hydrogen when the wind isn’t blowing, and the sun isn’t shining.

The cost to make hydrogen

The Royal Society plan includes 89 GW of hydrolysers, operating with a 28% capacity factor. To put that into perspective, those hydrolysers, when fully operational, would consume 3 times the UK’s current average electricity demand. Their construction would take 8 year’s worth of the world’s existing hydrolyser production capacity and consume enough water to supply a small town.

The Royal Society assumed a cost of $450/KW (£333) for hydrolysers, including the balance of the plant (transformers, rectifiers, water treatment, drying, compression, buildings, foundations, access roads etc). Those costs were amortised over 30 years at 5%, and operating and maintenance costs were estimated at 1.5% of CAPEX per year, assuming free electricity from surplus renewables.

The estimated costs come to £26.7/GW, or £2.37 billion per year for 161 TWh of hydrogen. That works out to $14.75 per MWh.

A UK government report published in 2021 forecasts the cost of hydrogen to be about £55/MWh when produced from surplus renewables with electricity assumed to be free. That would put the annual cost at £8.8 billion.

Another report, published in 2023 by the hydrogen council, based on a survey of actual costs, puts the present cost of hydrolysers at $1,800 to $2,000 per KW inclusive of the balance of plant. Using the mid-point of that estimate would give an annual cost of $9.9 billion. That would add £17.37/MWh to the overall cost of electricity.

Next we look at storage.

The Royal Society report includes an annualized cost of £32.1 million per TWh for storage, which works out to £3.9 billion/year and adds £6.93 to the cost of electricity.

I haven’t found a reliable references for the cost of storage caverns, so I will not change the Royal Society figures. However, I suspect their estimate is too low.

Next, we need to add power generation from hydrogen.

In the original Royal Society report published in 2023, the method proposed for the generation of power from hydrogen was reciprocating gas engines. The latest proposal is for the use of fuel cells. The estimated annualised cost is £25.2 million, based on 100 GW of installed capacity and a capital cost of ְ£315/KW. The same 30-year amortisation and 1.5% operating and maintenance costs have been used (assuming free fuel). That would add £4.42/MWh to the price of electricity.

Fuel cells at utility scale are a new technology and there are not many reliable estimates available. However, it seems clear that the costs assumed in the Royal Society report are wildly optimistic, for example:

The US EIA, in its annual energy outlook (2022), forecast a capital cost of $6,639/KW, more than ten times the cost assumed by the Royal Society.

Horizon Educational claims that prices in 2023 have fallen to $1500/KW, but that is only for the fuel cell stack, it does not include the balance of plant.

The only fuel cell project of any size mentioned in the IEA report “Projected costs of generating electricity” is a 15 MW plant in France with a capital cost of $2,361/KW.

The world’s biggest fuel cell power plant was built in Korea in 2021, it’s a 79 MW plant and it cost $292 billion, that’s ҄£2,738/KW.

The figure of £315/KW seems to be based solely on wishful thinking.

I will instead use £1,000/KW, with the proviso that if fuel cell costs are higher than that, the alternative of using reciprocating gas engines or turbines is always an option. On that basis, the hydrogen-fuelled generators add £16.79 to overall electricity costs.

Costs are summarised in the table below:

I have not included any extra transmission costs. The Royal Society added £4/MWh for transmission and a network of hydrogen pipes. I suspect that figure is too low, but it would take a significant amount of effort to come up with a real estimate.

I have not done any analysis other than taking the Royal Society proposal and modifying the estimate to include more realistic costs. There are other questionable assumptions including the use of 74% efficiency for hydrolysers (versus ~60% typical for existing hydrolysers) and the use of 55% efficiency for hydrogen-fuelled generation. Using more realistic values for those assumptions could add as much as 10% to the cost of electricity.

Use of fake cost estimates to pretend that renewable power systems are cheap will fool some people, for now, but it will come back to bite them later. It is time to start being honest about the true cost of renewables.

Good analysis and more succinct than my own, but we came to similar conclusions.

https://davidturver.substack.com/p/lcoe-cost-wind-solar-renewables-plus-hydrogen