The Vote On Elon Musk's Bonus - No Winning Options For The Shareholders.

Some thoughts on the upcoming vote on Elon Musk's self-enrichment package.

First, let me apologize to those who are following me for my work on the green energy transition. I always intended for Substack to be the medium for publishing that work and nothing else. This article was meant for Seeking Alpha, but was declined, so I decided to publish it here. If you aren’t interested in the subject, don’t read it.

Shareholders meeting, June 13th

On June 13th, at the Tesla annual meeting, shareholders will be asked to ratify a massive compensation award granted in 2018 to the company CEO, Elon Musk.

After the initial grant of the award in 2018, Musk and members of the Tesla (TSLA) board were sued in the Delaware Court of Chancery by a Tesla shareholder. The plaintiff Richard J. Tornetta, claimed that the company was negligent in awarding Musk his very generous compensation package.

The package included a grant of 304 million stock options with a strike price of $23.34 which will dilute shareholders by approximately 10% when exercised. The award was subject to certain performance conditions, all of which were met, so all the options are vested as of 2023.

Tornetta claimed that Musk had exercised undue influence over the board and had dealt himself an unfair compensation package. Though the package was approved at the time by shareholders in a majority vote of 71%, Tornetta claimed that the information provided to the shareholders was biased and insufficient for them to make a reasonable decision.

Judge Kathlene McCormick agreed with the plaintiff and rescinded the award.

The appeal

Musk has stated his intent to appeal the verdict, but the appeal requires that Tesla propose another, more amenable compensation award, and pay the fees of the plaintiff’s attorneys. The attorneys, working on a contingency basis are claiming fees based on the implied value of the compensation package, with certain adjustments. They are proposing payment amounting to roughly 11% of the implied value of the compensation award, to be paid in Tesla shares. The massive value of the compensation award is such that 11% of the award would be a very generous fee for legal services, by far the largest ever awarded. Tesla would have to issue 29 million shares with a current value of about $5 billion, to the law companies involved.

The vote

The vote on June 13th asks the shareholders to once again approve the compensation award that they approved in 2018.

The legal implications are many and complex. The shareholder vote appears to be an attempt to do an end run around the court’s decision. A vote in favor of the compensation package will no doubt open the company up to another round of court cases and a lot of uncertainty, a vote against will probably force the company to cancel the appeals and look for an alternative method of compensating the CEO.

Whether a new vote can overturn the court's verdict is a matter for the court to decide. An amicus brief submitted by Professor Elson of the University of Delaware suggests that such a vote cannot overturn the verdict of the court. Lawrence Fossi discusses that brief in more detail in his Substack article which is well worth reading.

I am not addressing the legal aspects of the case here, I am simply presenting the likely financial effects of the court's decision as it stands, versus the effects of reversing that decision and allowing Musk’s compensation plan to stand. I have used a Tesla share price of $177 to calculate the valuations.

The value of the compensation package

Reports in the media have placed a value of $56 billion on the compensation package. That figure is based on an assumption of a $650 billion market cap, which was the market cap needed for the final tranche of options to vest.

The real value of the package is dependent on the price of Tesla shares. At the high point of Tesla's share price in 2021, the package would have been valued at $110 billion if it were to have been exercised at that time. The shares are trading at $177 at the time of writing. The difference between the option strike price and the share price is $153.66. If exercised at today's share price the compensation package would be worth $46.7 billion before tax.

The plan is the largest potential compensation opportunity ever observed in public markets by multiple orders of magnitude—almost 200 times larger than the contemporaneous median peer compensation plan and over 25 times larger than the plan’s closest comparison, which was Musk’s prior compensation plan.

No clawback provision

Tesla's share price and market cap have fallen since the vesting conditions were met, only 9 of the 12 tranches would qualify to vest at the existing market cap. However, there is no clawback provision, the options once vested, remain vested. The plan only required that the financial targets be hit once, and the market cap target be met for a six-month period. Under the terms of the compensation plan, Elon Musk would receive all 304 million options irrespective of what happens to the company's revenue, profitability, and share price going forward.

Although the plan may have incentivized Musk to develop Tesla’s business to meet the targets, there is nothing in the plan that provides an incentive once the options are vested.

The financial effect of the compensation plan being nullified and the legal fee paid by Tesla

For accounting purposes, stock option awards are valued at the time the option is granted. Tesla has recorded stock-based compensation of $2.28 billion which was deducted from GAAP earnings over four years based on the board’s assessment of the likelihood of the options vesting. If the plan is rescinded, that cost will be nullified, resulting in a GAAP profit of $2.28 billion, probably resulting in a restatement of earnings for the periods when the share-based compensation was recorded.

The legal fees of $5 billion, if approved by the court, would be charged against GAAP net income, so the net effect of the transaction, if the legal fees are upheld by the court, would be a pre-tax loss of $2.72 billion. However, the legal fee has not yet been approved by the court, and may well be reduced.

There would be no impact on cash flow.

The shares would be diluted by less than 1%.

Presumably, the attorneys will sell the shares to monetize their fees. When a large block of shares is sold it is reasonable to expect a fall in the share price. It is not possible to determine the precise effect of the sale because other factors also affect the price, but we can look at the effects of previous large sales as a guide.

In 2021, Elon Musk exercised 66 million (split adjusted) stock options from his 2012 performance bonus award and sold about 30 million shares to pay the strike price and associated taxes. The sales took place in the final quarter of the year and were a contributing factor in the fall of Tesla's share price by 15%. In the period since that sale, the share price has not recovered.

In fact, the drop in share price on Musk’s exercise of the options reduced the value of his shareholdings by more than the value of the shares that were acquired. His net worth went down after he exercised his options.

Elon Musk's Tesla share sales in 2022 also correlate with drops in Tesla's share price. The major impacts include a 12% drop from sales of 29 million shares in April, a 6% drop after sales of 23 million shares in August, and a 14% drop after sales of 19 million shares in November. All those transactions took place in a period when the Nasdaq index was flat, market moves were not a factor.

Based on the sales in 2021 and 2022, it seems reasonable to expect that a 29 million share sale would drive down the price of Tesla shares by 10 to 15%.

However, the attorney fees will probably be negotiated downwards, so the effect on GAAP earnings and the share price could be less.

If Elon Musk’s compensation plan is re-instated

If Elon Musk’s compensation plan were to be reinstated, he would be entitled to purchase 304 million Tesla shares at $23.34 at any time before the option expiry date in January 2028.

The shares have a stipulated 5-year holding period, except that Musk is allowed to sell a portion of the shares to cover the cost of the strike price and the taxes.

There is no impact on GAAP profit from the award itself, the accounting value of the stock option award has already been written off. However, the gain on the shares is treated as income and valued for tax purposes at the market price when the shares are exercised. The company would have to pay the payroll taxes on that income. In 2021, Musk’s exercise of the 2012 stock option award resulted in a payroll tax of $340 million. The payroll tax on the 2018 compensation plan is likely to be in the region of $1 billion which would negatively impact pre-tax GAAP profit and cash flow.

Tesla’s cash flow would increase by $7 billion from Musk’s payment of the strike price. It would be cash from financing, it would not affect the income statement.

Shares would be diluted by about 10%. Since the future price of the shares is normally based on a multiple of price to earnings, the dilution would presumably result in a long-term reduction of 10% in Tesla's share price versus the price at which it would trade without the dilution.

Sale of shares to pay taxes and strike price

Musk has until January of 2028 to exercise the options. The payment of taxes and the strike price are due on exercise, irrespective of whether or not he sells all or part of the options.

He would almost certainly sell shares to pay the strike price and the taxes, as he did when exercising the 2012 grant. The tax situation is complicated by Musk’s move to Texas part way through the grant period. Federal taxes and fees amount to 40% of the net gain, but Musk may have to pay state taxes to California for a large part of the gain since he was a resident in that state for most of the period during which the compensation was earned. California state taxes would be 13.3%.

It would be unwise to wait until the last minute before exercising the shares because the sale would have less impact on the market if it is spread over a longer period. However, that decision would be for Musk and his advisors, and in any case, it will probably take a year or two for the courts to reach a final decision on the compensation award.

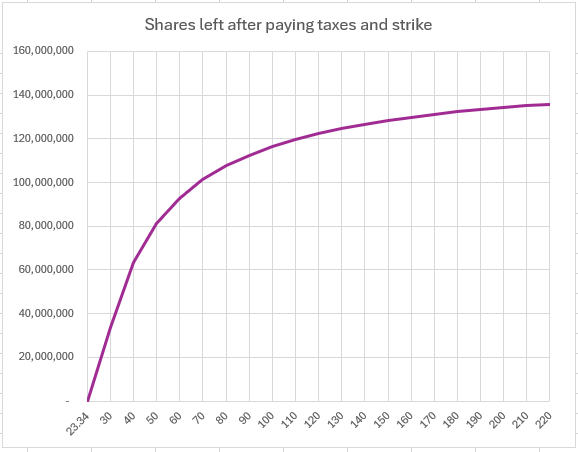

It does benefit him to exercise the options and sell the shares at the highest possible share price. As you can see from the chart below (based on a 50% tax rate), as the share price falls, the number of shares he would have left after paying the strike price and taxes also falls, dropping rapidly as the price approaches the strike price.

If he were to exercise the options at today's share price he would be selling more than half of the 304 million shares to cover the taxes and strike price. The remaining shares would increase his holding in the company to about 17%, still a long way short of the 25% he has been requesting.

The other benefit he gets from exercising the options at a higher price is a higher cost base for future calculation of capital gains and losses. The exercise price determines the cost base for the shares. If he sells in the future, he pays capital gains tax on the difference between the selling price and the exercise price, or he can claim a capital loss if the share price is less than the exercise price.

The sale of such a large block of shares would almost certainly put downward pressure on the share price. If previous sales are a guide, it could result in a share price drop of 40 to 60%, but probably less if the sale is spread over a long period.

When is a deal not a deal?

I have seen many social media comments claiming that "a deal is a deal" and because Tesla's results met the terms of the CEO compensation plan, the award should be paid. However, the court has already determined, after reviewing the evidence, that the compensation plan was unduly influenced by the ultimate recipient of the award. It has been declared illegal and if the amicus brief submitted by a well-respected professor of law is correct in its interpretation of the case, it will remain illegal irrespective of the outcome of the shareholder vote.

It's a vote of confidence in Musk's management.

Certainly, the company, and by implication the shareholders, will be better served if the award is rescinded. A compensation award equal in value to more than the company has earned in its entire life can never be a benefit to the shareholders. If the award makes it through the courts and the options are exercised, the biggest winners will be the American treasury and the losers will be the Tesla shareholders. Musk will own more shares but may lose more in share devaluation than he gains in additional shares, as happened when he exercised his 2012 compensation award.

The question arises as to what Elon Musk will do if the shareholders do not ratify the award. He is probably aware that ratification does not overturn the court's decision to rescind the award.

The danger for Tesla shareholders is that Musk is treating the vote as a vote of confidence in his leadership.

He may even be looking for an excuse to move away from a business in which he appears to have lost interest. He has already put forward a demand for a 25% share in the company, along with a threat to take the Artificial Intelligence business into a separate company. He is known to be raising capital for this AI business. Ratification and ultimate approval of the compensation plan do not get him close to the 25% ownership he is demanding.

Promotional material put out by Tesla’s board chairman, Robyn Denholm certainly seems to suggest that the company’s future rests on the shareholder vote. In a video on the Tesla Investor Relations webpage and in a letter to stockholders, Denholm claims that approval of the shareholder plan and moving the company’s domicile to Texas are critical to the future of the company. But she doesn’t explain why those measures are critical.

What does she mean by “critical to the company’s mission and extraordinary growth”? The statement implies that the company cannot continue to grow if the shareholders don’t approve Musk’s self-enrichment plan along with a move out of reach of the Delaware courts.

Why would a CEO who owns almost 13% of the company and whose entire net worth is tied up in shares of the company, need a massive compensation plan to motivate him to work for the company?

How will moving the company domicile to a state with very little history of business jurisprudence affect the development and manufacture of cars (with or without self-driving), energy products, robots, or any other business they might decide to pursue?

Deholm’s statements only make sense if Musk is threatening to do something drastic if the vote doesn’t go his way.

He is known to make irrational, spur-of-the-moment decisions, I would not be surprised if a "No" vote resulted in his resignation as CEO, even though such a move would be detrimental to his own wealth.

His resignation would certainly impact the share price. Without his promotional efforts, there is always a danger that Tesla would be viewed as an ordinary automotive company and valued as such, and the shares would see a significant price drop even if he didn't sell. If he were to resign and also sell his shares it would put additional downward pressure on the share price.

A lose/lose situation for the shareholders

There is no winning move for the shareholders of Tesla, but a “No” vote would send a strong signal to other rogue CEOs who can’t seem to distinguish between the company’s interests and their own.

Executive compensation has gotten out of hand in public companies in the USA. It is time for shareholders to make a stand.