The UK Department of Misinformation

Why does the UK government insist on publishing misinformation about the real costs of renewable power?

Every three years the Department of Energy Security and Net Zero (DESNZ) in the United Kingdom produces an estimate of the costs of electricity produced by wind, solar and natural gas.

DESNZ is a government department created specifically to supervise the pursuit of Net Zero. The department employs 4,000 people whose livelihood depends solely on promoting Net Zero.

Their last cost estimate was produced in November 2023, and can be found at this website:

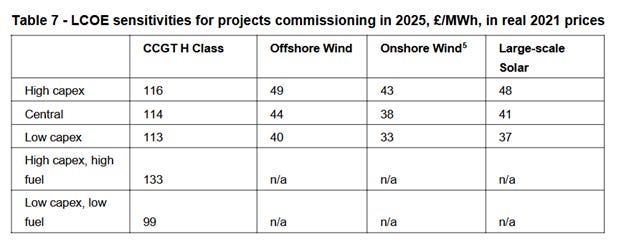

The estimates published by DESNZ predict much lower costs for renewables than the quotes received for real projects. Let’s take a closer look, here is a table from the DESNZ report, showing the estimates of levelized costs of electricity for projects commissioned in 2025,

This is how those estimates compare with real quoted costs, as per the latest round of bidding (AR6, published September 2024), using the mid-points of the DESNZ estimates:

The real cost of renewables is 43 to 57% higher than the DESNZ estimates.

The DESNZ report contains a disclaimer with a garbled explanation as to why their estimates are different from the actual contracted prices that will be paid by electricity consumers. However, the real reason the DESNZ estimates are wrong becomes apparent if you take the trouble to read the remainder of the report and check the sample calculation that is given in Appendix B of that report.

Taking offshore wind as an example (it is the mainstay of the UK’s proposed future power supply).

Capital cost

The capital cost used by DESNZ is £1,630 per kW, including pre-development costs. Compare that to quoted costs for some recent installations:

East Anglia ONE £2.5 billion 714 MW, cost per KW - £3,500 in 2021

Hornsea One £4.2 billion for 1.2 GW, cost per KW - £3,500 in 2022

Moray East £2.6 billion for 950 MW, cost per KW - £2,736 in 2022

Dogger Bank £9 billion for 3.6 GW, cost per KW - £2,500 in 2023 to 2026

IRENA gives a capital cost of $3,300 to $5,000 per KW for offshore wind (£2,700 to £4,100)

Capacity factors

An even bigger discrepancy arises when you compare the projected capacity factors with what is actually being achieved. DESNZ uses a capacity factor of 61% for 2025, which includes an assumed 95% availability factor (64% before applying the availability factor). Beyond 2025, capacity factors of 69% are being used.

I have no idea where those numbers come from, the DESNZ report contains a reference to a study that evaluated potential improvements in wind turbine capacity factors, but the maximum factor suggested by the report is only 52.9%.

Actual results, as per this reference site, don’t come anywhere close to the assumed 61% factor. The only wind farm that has exceeded 50% over its lifetime is the Hywind, which is a very small floating offshore farm that cost £8,800 per KW to construct. Average capacity factors are below 40%, with newer turbines typically in the range of 45 to 48%.

Wind turbine capacity factors are known to decrease as the turbine ages and the blade edges wear. DESNZ makes no reduction in capacity factor over an assumed 30-year life.

The real reason that DESNZ estimates are too low is that they have low-balled the estimates of capital costs and have used wildly optimistic estimates of the productivity of offshore wind turbines.

Correcting the DESNZ estimates, using a more credible capital cost of £2,630/kW and a capacity factor of 45% results in an offshore wind cost of £81.32 per MWh, about twice the DESNZ estimate.

The offshore wind suppliers can offer lower prices because their fixed price contracts are tied to the inflation rate, they are guaranteed price increases every year. Using the DESNZ spreadsheet and adjusting the future income to allow for inflation at 2% per year will give an estimated cost almost equal to the costs quoted in the AR6 bid rounds.

Comparison with gas turbines

It should also be noted that the DESNZ estimate for the cost of power from Combined Cycle Gas Turbines (CCGT) is £114 per MWh, much higher than the real cost of gas fired power. That’s because DESNZ includes a carbon charge of £60/MWh for 2025. But that carbon charge is not a real cost, it is an arbitrary figure deliberately added to increase the apparent cost of gas-fired power. Even if it were to be imposed as a tax on carbon, there would be an offsetting income to the public purse as collector of that tax, the net cost to the public would be zero. It’s analogous to comparing the cost of operating ICE vehicles versus EVs but ignoring the fact that taxes on the fuel for the ICE vehicles pay for the roads.

These estimates be a problem if the DESNZ documents were published and no-one read them, but the estimates are used by consultants, academic institutions and government departments such as the Climate Change Committee (CCC), and by DESNZ itself, to evaluate and develop plans for the UK’s energy systems in its path towards emission free energy.

Reports from consultants, academic institutions and the CCC then feed back to the government and are used to establish policy. This creates a feedback loop where, if the information published by DESNZ contains errors, then the various reports and the plans produced by the CCC propagate those errors and lead to wrong-headed policies.

Those wrong-headed policies have driven up the cost of electricity in the UK to the point where it is destroying the economy.

I ask:

Are the people at DESNZ incompetent?

Are they being fed misinformation?

Are they suffering from extreme cognitive bias because their livelihood depends on propagating the myth of cheap wind and solar power?

Or are they being instructed by their political masters to produce misinformation?

Whatever the reason, it needs to stop.

A couple of comments. How did you index LCOEs in 2021 money in comparison with AR6 CFDs awarded in 2012 money? There are still no official indexed current prices until they are issued following the indexation update in April: I previously tried to persuade LCCC to provide current indexation levels on newly awarded CFDs but they refused to do it on the grounds that the regulations don't require them to. Avoiding misleading journalists and the public was not on their agenda. OTOH CPI indexation is easy to calculate from ONS data.1.4 is close enough to the April 2024 indexation factor from 2012.

I'm not sure I entirely agree with your carbon tax analysis. There is no payment to the Treasury for any remaining grandfathered allowances. From the consumer point of view to the extent that gas prices are still setting wholesale prices they find themselves paying an extra bonus to nuclear and renewables on ROCs that is only subject to CT clawback to the Treasury. In tight markets prices are set by demand destruction and not by cost. In those circumstances the real tax is the lack of adequate capacity.

"Are the people at DESNZ incompetent?

Are they being fed misinformation?

Are they suffering from extreme cognitive bias because their livelihood depends on propagating the myth of cheap wind and solar power?

Or are they being instructed by their political masters to produce misinformation?"

OR ALL OF THE ABOVE?

BTW, thanks for recommending My Two Cents.