Tesla's Missing $1.4 Billion

I present an alternative explanation refuting the claims in the Financial Times article.

Earlier this week, an article was published in a highly respected newspaper, Britain’s Financial Times. The article, written by the journalist who uncovered the Wirecard scandal, implied that there could be $1.4 billion missing from Tesla’s accounts.

The basis for the accusation is a calculation of the difference between what Tesla shows as its capital expenditure and the amount that was recorded as property, plant and equipment on its balance sheet.

I believe this accusation is incorrect and there is a logical explanation for the apparent discrepancy.

When Tesla (or any other company) receives goods and services that are classified as capital expenses, the value of those goods and services are added to the company’s assets.

The book entries are:

The value of the asset is added to “property, plant and equipment”

There is an offsetting liability (or a reduction in assets) which can be recorded in one of three places:

If Tesla has not received an invoice for the goods and services, the liability is added to “Accrued liabilities”, or

If Tesla has received an invoice, but has not yet paid for the goods and services, the liability is added to “Accounts payable”, or

If Tesla has paid for the goods and services, there is a reduction in “Cash and cash equivalents”

Capital expenditure (Capex) appears on the cash flow statement not on the balance sheet. It is a cash flow item, and it includes only those capital expenditures for which Tesla has made a payment.

So, there is always a discrepancy between what Tesla includes in “property, plant and equipment” on its balance sheet and what it records as Capex on its cash flow statement. The discrepancy is a result of the timing of payments, some items may be recorded as property, plant and equipment in one quarter, but don’t show as Capex till the bills are paid which might be in subsequent quarters.

Note that the place to look for the information is not on the balance sheet itself, because the PPE number on the balance sheet includes depreciation. The information can be found on page 72 of the 10-K, the number to look at is Gross PPE, which is the total before depreciation.

Some time periods will show capital expenditures that are higher than the additions to PPE. Those are periods where Tesla paid for capital equipment and services that were received in previous quarters.

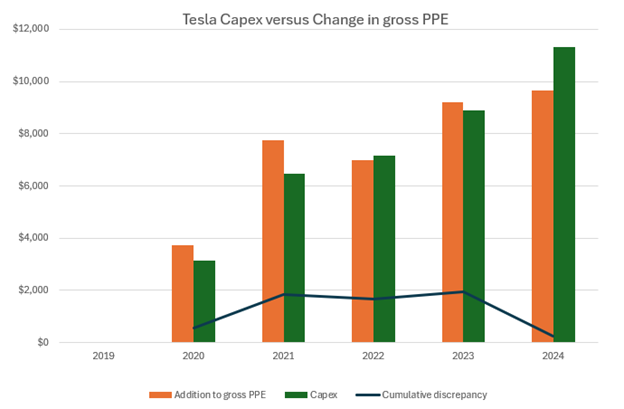

If, instead of looking only at two quarters, we look at Capex and PPE over a five-year period, we can see that over the long term the two come back towards a balance, but the cumulative additions to PPE are always higher than the stated Capex.

As you can see from the chart, over the past five years, additions to gross PPE have sometimes been more than Capex, sometimes less. However, the cumulative sum of gross PPE is always higher than the sum of Capex. That’s because there are always capital expenditures that have been booked as PPE on the balance sheet but not yet paid.

The Financial Times article only looked at the past six months, which happened to be a period when Tesla paid for a lot of capital expenses that had been booked as PPE in previous periods. That led to the conclusion that $1.4 billion is missing. It isn’t.

There is plenty of activity at Tesla that borders on what many people would consider fraud.

The CEO himself is prohibited from denying that he committed fraud in his infamous “funding secured” tweet.

Full self driving is a massive consumer fraud, where many have paid for a service that has never been delivered. Denying warranty claims for repairs that are known to be a result of defective components is fraud.

Using Tesla shares to rescue your family’s bankrupt solar business is fraud, especially when it’s promoted to the shareholders by making fraudulent claims about a non-existent product.

Elon Musk regularly makes statements that test the limits of legitimacy, some are clearly false, others hide behind a shelter called “forward looking statements”. When those statements have no clear basis in reality, many people would consider them fraud.

However, in looking for fraud in Tesla’s audited financial statements, we might be setting out on a wild goose chase.

There is also a lot of speculation about Elon Musk’s potential margin call against his borrowing. I have also analyzed that based on Tesla’s financial statements, but you will have to go to Seeking Alpha for that article.

https://seekingalpha.com/article/4769459-elon-musk-potential-margin-call-the-facts

Funny… Elon happens to have an annual Twitter debt bill of $1.5bln.

https://www.thestreet.com/technology/elon-musk-has-a-huge-twitter-debt-bill

Interesting point. But what does US GAAP requirement say? Should the impact of the movement of capex payable not be presented? And is this effect of movement in payable not already taken into account in the movement of working capital items?